Recently, I had the very unpleasant experience of having a corporate credit card cut my line of credit with them by 80% for no warning and no reason. Before you start to wonder, yes, I had made every payment on time, paying in full, monthly, for the last 7 years. My credit score has remained stable. Bramble Berry’s business has grown this year (thank you, thank you, thank you!). The company is stable. I am stable. There is nothing to ‘flag’ my account that this company can explain or I can figure.

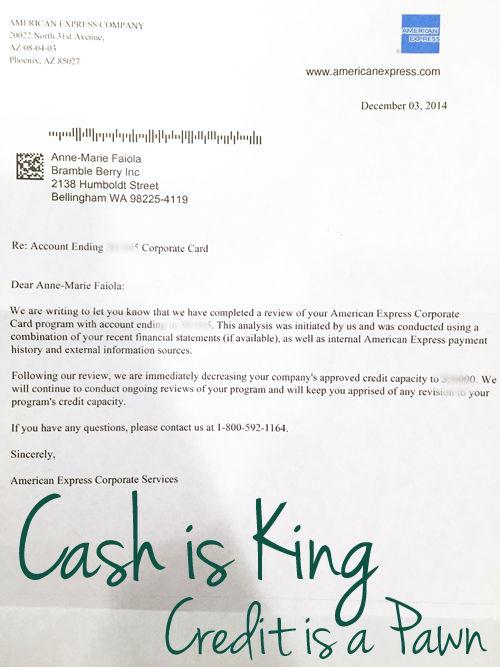

They sent me the form letter above. It’s cryptic and, it’s not even signed by a person. Meanwhile, it’s Q4, or ‘Busy Season’ when I actually use a line of credit to handle inventory swings. I have to wonder if my line of credit was cut because this company isn’t making any money off of me; I pay my line in full every month. There’s nothing to gain there. Or maybe it’s because I don’t play the Dun & Bradstreet game and refuse to give them my financial information because that information then becomes transparent to my (eh hem) fellow vendors (aka: competitors).

While I really want this bank to be persona non grata at Bramble Berry actually doing that that would be stupid. I’ll swallow my pride and beg for my credit back because it’s important to keep all options open for my business. But, this is a good reminder to me – and now, to you – to consider this lesson: depend on yourself, not banks, to grow your business.

Fiscal responsibility is a must in business. Recently our hilarious accountant made a “Fabulous Fiscal Exfoliant Soap Bar,” made from cut up credit cards.

Fiscal responsibility is a must in business. Recently our hilarious accountant made a “Fabulous Fiscal Exfoliant Soap Bar,” made from cut up credit cards.

Just like in the crash of 2008, banks won’t save you. You only can depend on yourself and the cash you have to invest in your own business. The problem with the unexpected credit limit decreases, besides the obvious pain of not having the financial tool to do its job, is simple – it wrecks your debt-to-credit ratio if you carry a balance. Your available credit limit makes up almost a third of your FICO score.This is why it is so important to have a business you can bootstrap yourself. You need to spin off enough cash monthly to fund your expansion. What does this mean for you? Consider the following:

December Sales $6000

COGS + overhead + taxes $4600

Profit $1400

In theory, you have $1400 to invest in your business this upcoming month – and, if you can’t count on banks or corporate credit cards, this means that you literally have $1400 to spend on replenishing your inventory, buying new equipment, buying labels – all important things a growing business needs. If you have a credit card or a line of credit and a way to pay it back, absolutely consider using it (I have, I do, and I will in the future) but do not make it your business plan.

When I sold soap at markets years ago, sustainable lines of credit were not an option. This taught me to save like crazy, and create a stable business plan.

When I sold soap at markets years ago, sustainable lines of credit were not an option. This taught me to save like crazy, and create a stable business plan.

This isn’t the first time this has happened as I’ve struggled to grow Bramble Berry. Ironically, this same corporate card issuer pulled this trick two years ago and I jumped through their hoops to get my full line (plus!) back. This time, I’m going to jump through the hoops because open lines of credit are something to never squander but, I’m not counting on it. And you shouldn’t either. What this means:

ONE: Build a war chest of your OWN cash. Save save save when you can so that when your lines get cut, you can fund your business.

TWO: Do not depend on credit to build your business. It’s easy. It’s there. It seems like a good thing to do. And while it’s there, sure, use it. But always, ALWAYS, have a Plan B.

THREE: Don’t act emotionally. It is tempting to ‘show them!’ and cut your card. Trust me, I want to do nothing more right now than cut up my corporate card, make an art project out of it, and mail it to the President of the credit card company. I will not do that. I will send them everything they ask for (including those DNA samples and deeds of trust to my child’s first house) to ensure I keep lines of credit open for a rainy day.

FOUR: Make nice with other banks; always have a back-up card or back-up bank willing to loan you money. I’m okay because I do have a conservative cash position and I have a partner bank that is willing to help finance seasonal inventory fluctuation if I need it (curious about how to get a line of credit? I wrote a blog post on it right here).

This is your wake-up call; if you are building a business, do not depend on someone to save you. Make your own cash. Save your own lines of credit. And build a business that is self-sustaining without having to rely on anyone else.

Been there. Done that. The bank was Chase. They did the same to me because the interest rate they had given me was 2%. They raised it to 6% even though I always paid double payments. Fortunately for me I had a parent to borrow the balance amount from. Paid off Chase and closed all six of my business and personal and savings accounts with them. When they asked why, I gave them the same answer they gave me when I asked them why they had tripled my interest rate….”because I can”.

I opened accounts with a small local bank that was happy to get my business.

PS and I got $90 when they settled the class action lawsuit against Chase for violating the terms of their agreement with others just like me. Sort of sweet.

Oh that’s interesting – the class action lawsuit – who knew that there were others like you!?

We have two great local banks that we work with – in fact, one just stopped by with a huge gift basket and made me feel super loved =)

This has been such a time-sensitive reminder to me that having multiple options is so important and my goal should always be to build a company that works (!) which includes being self-funded, even for inventory swings =)

Thank you for sharing this aspect of your business with us. This is particularly timely for us as we are just in our fourth month of operations and are doing exactly as you propose: funding ourselves. It isn’t easy, but it is worth it. We are seeing a gradual increase in profits and are able to invest them back into our business, even if we are still working our day jobs because we can’t ‘pay ourselves’ yet. That will come. All very sound advice, and the use of the seasonal inventory back-up card is a good rule-of-thumb. Whether the bank chooses to lower the limit or not, continuing to pay off the balance is always wise because otherwise debt creeps in, doesn’t it? Anyway, thank you. And we will certainly continue to purchase our soap-making supplies from Brambleberry:)

It’s tough because it’s so much slower growth than getting a line of credit and/or a loan or taking on investors. But it’s also less stress for you when your company can throw off the cash to grow. Debt can be successfully used as a tool in business; I don’t want to discount that but, it’s also fraught with anxiety and pitfalls so it’s good to have lots of plans (and, save up for that rainy day in your bank account) =))

I came across this blog post while looking for natural made soaps, and I am a little dismayed at the lack thought put into this post. You admitted you would not furnish the bank with financials it needs to analyze whether, in the future, you can repay your obligations. You may be paying them now, but sometimes the effects of current changes in sustainability do not actually present outwardly until months later. The bank wants to protect themselves from that. First people were mad when banks would just loan money to anybody without making sure they could afford their obligations. Now people get pissy when banks do their due diligence. It would seem that this isnt a case of the bank being wrong, but a case of you wanting something to be mad at. You have no reason to be mad at them. You said you would not provide the financials they require. If you want to utilize other people’s money (that is what a line of credit does, in essence), then you need to show you are good for it. This is your fault, not theirs. Stop blaming the big bank for doing what people have been asking them to do. n ow they do it, and you get mad? That is just plain sad.

I am sure the bank would love to see this blog post. I am sure they would be more than happy shutting down your line of credit completely. Oh, also you wouldnt be showing your hand to your competitors. That happens if you are publicly traded. Guess what, as a natural soap maker, you arent. You never will be either. I saw what you have for sale, and it looks great, but I will not be buying. I want to make my purchases from someone who understands how the world works.

I am sure you will delete this, or come up with some ridiculous idea to use as a counterpoint, but in the end, you know I am right: you are mad because you didnt play along, and the bank called you on it. If credit is so bad, volunteer to shut down the rest of your line of credit. By not doing so, while still rallying against credit and how awful it is, you become not just uninformed, but also a hypocrite.

Wouldn’t it be nice if everyone had the world figured out like Mark does? Being an entrepreneur and coming from an entire family of entrepreneurs, I know how banks/credit companies/the government are towards small business. They act as if they support it but spend more time trying to shut you down than anything else. Obviously Mark is naive to how creditors and banks work or just hasn’t had to deal with problems personally. Don’t be so mean to Anne Marie, dude. And to not buy from Bramble Berry because they don’t know how the world works?? You’re hilarious! What kind of bubble do you live in? (I want one, sounds nice)

Anne Marie, don’t listen to this contrary Gus. You’re my friggin idol and I wish you were my BFF! Lol seriously you’ve been SUCH an inspiration to me and are a large part of the reason that I started creating bath and body products (and I really do wish you were my bestie lol)

Lots of love, best wishes, and good luck with the banks and all that old crap.

Let me ask you this, James: should a bank loan money to someone who will not show their financials to prove they are a healthy enough entity to be able to repay their obligations? Everyone got pissed when banks contributed to recession because they were loaning money to people who couldn’t repay it, yet now that they are making sure the people they give loans and credit to CAN repay it, people are pissed. Seriously, which one is it? You can’t have it both ways.

Ummm…I think what people got mad at was the banks making bad loans AND GIVING BANK CEO’S giant bonuses for their bad behavior. Oh, by the way the banks are allowing 100% financing options on homes again. Someone has a short memory.

The funny part is that a 100% financing option on a home is perfectly ok, provided you can pay for it. Banks ask you to prove it by providing financials. Banks made bad loans because they were NOT doing their due diligence.

You said, “I think what people got mad at was the banks making bad loans AND GIVING BANK CEO’S giant bonuses for their bad behavior.” actually, what got people mad was not just bonuses, but also that people were losing their homes because they could not make the loan payments and then they lost “their house.” Well, it isn’t really “your house” if you have a bank providing you the financing to get it. People have always been mad at CEOs making bonuses, that isn’t unique to this situation.

Mark – I’m sorry you didn’t understand the intent of the blog post. As stated in the blog post, I absolutely will be providing everything the bank asked for (and more). I’m not sure where you got the idea I wouldn’t provide financials to the bank. That would be insanity to believe a bank would give me a line of credit without me providing proof I could pay it back. You and I agree there.

Ironically, the bank did see my blog post, reached out to me to apologize for cutting the line of credit with no warning, and they have all my data to reinstate the line promptly.

The blog post was designed to remind entrepreneurs to always have a Plan B, to not make someone else or something else your Plan A.

Thank you for your spirited thoughts. It’s great to have so many passionate people reading this blog.

I remember the financial adviser Suze Orman actually warning people on one of her shows last year( I think) not to pay off credit cards in full right now. She admitted that she usually advises the opposite but that right now d/t the economy, CC companies are getting stingier and chopping consumers’ credit lines. You’re right Anne-Marie. Amex isn’t making enough money off of your company and this is how they react.

Oooh, I love Suze Orman. She has such a great straight-talk way about her, doesn’t she? =)

This was such a great reminder to make sure that I have all my back up plans in place for everything to really ensure that Bramble Berry has a solid and strong financial future for decades to come. And, I’m pleased that people are reading it and also learning from my lessons-learned =)

Thanks for sharing this aspect of your business Anne Marie. It helps with my perception of your seeming very “togetheredness” and shows that you too have issues with banks just like everyone else! I see how they would decrease your limit if they aren’t getting what they want out of you. I personally don’t care for them for many reasons and choose to use a business card from another bank.

I have a store in an area that has seasonal fluctuations. I carry debt on my card a good bit of the year but make a weekly payment on it throughout the month every month to keep things in check. By end of December the card gets totally paid off and I go into my new year without debt and it stays that way for awhile until I have to start buying again for the busy season.

I could never pay cash when I’m buying for certain busy months. I have to anticipate sales on past years, plan for and buy ahead of time. This can be hundreds into the thousands of dollars. The card is what carries me. The interest I pay is just a part of doing business and I write off. For me it’s the trade off I get for the flexibility I have with the card.

I do have a back up card. Not to charge more but just in case. A good example is just a few weeks ago. There were a couple of fraud charges on my business card. In order for the bank to file a report they had to close the account and issue another card to me. At that time I had at least five outstanding orders that needed to be charged and shipped. The new card didn’t get expedited in the day or two they said it would and luckily I had that other card to keep things running and deliveries shipped to me on time.

That being said, and with a nod to cash being king, throughout the year I am also putting CASH aside to be sure I get through those first few months of the year when it’s slow, the weather might be bad, etc. Usually I do fine and can then use that saved money to start buying again for the spring. I could have used the cash I saved and paid for those orders then paid that “cash savings” back at end of year. But oh, I do like my rewards points and always use them at the end of the year back against my card as a credit which helps offset some of the interest I paid during the year. It was 600.00 this year so that certainly helps! Plus because the bank screwed up getting my new card to me they gave me a couple thousand points extra.

It’s best to give yourself options and not just one form or way of doing business. Backups are king as well! Sorry this was long but wanted to share my experiences and HTH.

I totally know what you mean about the seasonal inventory fluctuations. It’s harrowing to have to do that but hopefully, every year, you are making it longer and longer (even if it’s just a week) before you have to put inventory on a credit card – like you’re doing with the cash.

I agree; I love the rewards with credit cards and that’s one thing that local banks and their friendly, consistent lines of credit don’t have so there are many different ways to look at it.

I know what you mean about fraud. I’ve had multiple experiences with credit cards being closed due to fraud and that does put you in a bind if you only have one card to depend on. So much about business is about being prepared and planning for the worst but hoping for the best, right? =) Speaking of which, I wish you and your business a successful, joy-filled 2015 =)

Thank you for sharing this wisdom. It is important for all of us to know what is going on in the banking market place so we don’t imagine we are alone in (what I call) banking abuses. Part of our vision for our soap business, Vicki’s Body Candy, is to grow according to it’s income as I believe borrowing money to start a business starts you out (principles of energy) in the hole; you might say you are embezzling from your own future as you use money you do not have currently, but estimate you will have in the future.

I realize there may be a level at which credit floating helps expansion. However, as a published author, my publisher informed us authors way back in 2008 that certain HUGE bookstores would be going out of business because they depend on credit to buy books from the distributors and then pay the debt as the books sell – and that the distributor has stopped the credit lines…. so stores are sending back books as they can no longer afford to stock their stores. The books must then be sold as “used” even though they are in “new” condition – Amazon has taken good advantage of that. The major bookstores tried to diversify and finally – did disappear. This rocked the bookstore/selling business…. as you say, “Cash is King – Credit is a Pawn”. Cash backing of our companies – and our own personal lives is becoming more and more of a red flag message! Thank you for your voice.

“Happy Soaping Is Going On Here!”

Victoria ~ Vicki’s Body Candy

Wow, Vicki, that is a powerful story about the publishing industry and the lessons learned there. You are so fortune to have such a wise publisher that they were able to steer you through that time and that you were open enough to receive and act upon that message for your business now.

It’s interesting what you say about the karmic hole that borrowing money leaves you in. I hadn’t heard it put that way and you’ve given me something to think about with that observation.

Thanks for being a Soap Queen reader and for commenting! =)

Great post, and great advice. We also pay our CCs every month and never carry a balance. It’s also good to know that a successful, established business isn’t immune to these games. Some of us would get that letter and wonder if WE were the problem.

Ah yes, you’re right. Since there’s very little transparency in the letter, it’s hard to pinpoint what it is. I immediately went and checked my credit score with all three bureaus to make sure that nothing was awry there so that’s one of the reasons I felt more secure in writing this ‘hey, it happened to me, it can happen to you’ blog post. In this case, if I had only gotten notice 15 days ahead of time that the bank in question needed financials, I would have been thrilled to provide them (as I already have since this blog post was written) but to go and try to put a charge on your card, only to have it declined was quite an unwelcome surprise =) Congratulations on your thrifty financial practices.

Thank you so much for this post! At the moment, I am trying to pay off my CCs that were used to fuel my business! Totally want to be cash on the barrel kind of girl/business! =)

Oh I went through that phase too and it took discipline to get them paid off. I learned a valuable lesson about overestimating the amount of cash it takes to open a retail store when that happened. Keep being disciplined; it will pay off in the end (no pun intended) =)

<3

This was a really good post. I’m only 21 so like most people my age I have pretty much no credit. I thought about getting a credit card but banks don’t trust people my age to be responsible ( can’t say they don’t talk from some experience) and I end up getting a deal I can’t take. But boy do they want me to take out loans! Can only imagine why! 😛

My mom only uses debit cards and my dad only got a credit card in recent years. They always taught me to live within my means, the old school money-in-a-mattress lessons. Hopefully I can get my business going and get a good credit deal for when things get rolling!

Oh that’s so fascinating re: the banks really wanting you to take out loans but not wanting to give you credit cards. It sounds like your family really gave you some fantastic financial literacy lessons. You’re lucky to have such a great base to start from. =) Good luck with your business this year!

Yes, I recall a credit limit of mine being lowered, because I did not have enough open lines of credit. So, basically, if I’d had more cards, I’d have a better credit score. Makes sense – NOT! AND, this was after I’d sent them a large payment in order to free up my credit line. (Can you believe the woman on the phone had the nerve to ask where I got the money for the payment!?)

But, credit today is a real game. Brings to mind the year I found out that if I paid off a card and voluntarily closed the account, it lowered my credit. Yes, behave responsibly, and they don’t really want you. 🙂

It’s interesting that you have that same experience – I often will overpay my credit cards to negative balances when I know a big charge is coming up so I can fit the full charge on there – and that doesn’t seem to be very popular either =)

I’ve also had that lowered credit rating when closing a card; it’s a good mind game to try to keep up on it all =)

oh, boy! I remember BoA ditched me because every month, I ALWAYS paid my balance in full. They just sent me a letter saying that my account doesn’t remain enough cash each period…Hm… Ok then! Bye-Bye BoA.

Btw, I was a working student at the time. :-))))

Admire you and aloud!

… applaud!

Thank you Iryna. It sounds like we had a similar experience. It’s funny how that work; the most financially prudent are actually not the ideal customer for the credit card company =) Go figure.

Your articles always somehow have perfect timing 🙂 It is taking me a bit of a time building my soap business little by little but I am not doing it on credit I only spend what I have but do struggle , CC’s are tempting but its a choice between growing slow or taking the leap & use credit. Soaping is easy soaping as a business not 🙂 atleast at the moment for me.

Oh isn’t it tempting? It was such a good reminder for me because it got cut so quickly and without any warning. If you do use them – and they can be a valuable tool – always have a back-up plan to pay it back if things go sour with the bank.

This sort of real talk is one of the many reasons I admire you so. Thank you and I couldn’t agree with you more. Slow and steady win the race.

Thanks for your support Brenda! =)

Don’t know what it is about American Express that is keeping you coming back. For heaven sakes, they have a product, you are their customer, and they are not living up to their end of the deal. There are other banks. Good banks, small banks, local banks and credit unions. The ones who know your name when you come in, and know what you do in the community. The ones you actually have a RELATIONSHIP with. I’ve personally never liked AMEX, for a whole lot of reasons. I’d find a better option, and then I would cut up my card and never use it again. Oh, and totally agree with the “cash is king”. There are occasions to use credit, but it should be a tool, not a crutch.

Hi Jennifer – Totally agree with you that AMX should not remain on my best-of-hits list to go to for credit. We love our local banks and work with them on lines of credit. I like to have a variety of funding options, just in case. I’m a total worrier that way, always saving cash (and credit!) for a rainy day =)

In fact, I’m getting some awesome soap gift packs together right now for our wonderful local banks that we work with right now =)

Anne-Marie

I prefer banking with credit unions. They’re usually more flexible and understanding than traditional banks. I feel like CUs value my business more.

Perfect timing to write this post, although not actual perfect timing. This is the best advice you could give to anyone starting their business. It feels really good to not be in the red, ever. When I started my soap business, I had cut up all of my credit cards and told myself that if I started to go into the red for any part of my business, I would quit. Through thick and thin, I am a very busy, happy soap maker with an expanding business. This way is the slow way though.

Hi Linda,

There is always a time that may justify using credit (seasonal inventory swings come to mind) but ideally, if you can swing it, going cash only is the way to go. I founded Bramble Berry on a credit card (oh, the things I would tell that 20 year old me now! LOL!) and when we went on HSN, we had to do a full 90 days of inventory on credit waiting for them to pay; so there are times when using credit makes sense but the best plan is always the one that has your business spinning off cash for you to continue reinvesting in your company. =) Best of luck in 2015! I hope it will be a great one. =) Anne-Marie

Anne-Marie, you are the greatest! I still have an invoice from my Bramble Berry order back in 2005. It’s as a reminder of when I started and how I managed to stay in business . I was facing enormous medical bills and against all odds, I am still alive and still making soap. I am an older person and raised 4 children. I admire every single thing you have done and how you have grown your business. You now have little children and have kept everything together. Your advice is always top notch and very sincere. Thank you so much and Happy Holidays!

Aw, thank you! That makes me feel so good that you are on track and still in business, despite overcoming some very difficult odds. I know that didn’t happen by accident so kudos to you.

As for me, I am so lucky to have an amazing team both at work and in my family life as well. My kids have amazing teachers at school and loving nannies that help me immensely. Knowing they are well taken care of and loved puts me in the best possible mental and physical space to focus on work when I’m at work — and then focus on home when I’m at home. It is such a blessing and I feel thankful every day.

Best wishes for a beautifully serendipitous and successful 2015.

Thank you Anne-Marie – I completely agree. The best strategy is yourself.

What’s that phrase? Nobody loves your baby like you do =)