![]()

“I think, at a child’s birth, if a mother could ask a fairy godmother to endow it with the most useful gift, that gift should be curiosity.”

-Eleanor Roosevelt

Tutorials on soapmaking, bath fizzies, lotions and more

Filed Under: Personal Ramblings

![]()

“I think, at a child’s birth, if a mother could ask a fairy godmother to endow it with the most useful gift, that gift should be curiosity.”

-Eleanor Roosevelt

Filed Under: Business Musings

An idea not coupled with action will never get any bigger than the brain cell it occupied. ~Arnold Glasow

Filed Under: Business Musings

My Father recently sent me a random page he found on the ‘net that amalgamated all the footprints I’ve left on the ‘net for the last 13 years. Scrolling through the pages was a bit like going through an old closet – there were some bad choices made, some tacky things said and some dubious colorful commentary. Overall though, I wasn’t displeased by the pages and pages of references (some going back to 1998!). Generally, they showed a positive, forward-thinking businesswoman who sometimes spoke with too much candor but had a clear purpose in life.

When I started Bramble Berry as a naive 20 year old, I never envisioned where the internet was going. I didn’t realize that there would be hundreds and thousands of online communities started and then shuttered with their archives alive for everyone and anyone to see. I didn’t think of my words being like handwriting on a fogged up window, disappearing until someone came along and blew.

My entire life is out there on the internet just waiting to be excavated. Now, I’m lucky. I’m self-employed and (knock on wood) hope to continue in this fashion for the rest of my life. I don’t have potential employers scouring the internet to find my one or two indiscretions. I’m happily married; I don’t have possible suitors checking me out online before a first date. But, what I do have is potential customers searching about my company, making a value judgment on if they want to do business with us.

Every little thing you say, on every arcane forum or every forgotten blog or every long-lost site, is out there, ripe for the reading for anyone with a little bit of time on their hands and a basic grasp of the Way Back Machine.

What are you saying right now? Are you leaving trails that you can be proud of? Are you living your life offline and online with integrity and commitment to your values? Are the words you’re writing today something that you would be proud of your kids reading in 20 years? Yes, be honest. Be authentic. But, always be mindful of your reputation because every track you leave online is building the foundation for your reputation.

Filed Under: Business Musings

Filed Under: Personal Ramblings

I just bought a bunch of prints from this artist – all positive, happy sayings. I am going to frame them and put them up one by one in our hallway. They will look great in a row – and hopefully inspire everyone that walks by. If you have mental blocks you’d like to overcome (“I just can’t sell my products wholesale, I am too scared!”), replacing those negative thought patterns with a positive one (“I am easily walking into stores with samples and they love my products!“) takes frequent repetition, work and energy. These little sayings on my walls will help with my ‘repetition’ part.

Check out Valentina Ramos if you’re looking for affordable prints that inspire you every day.

Filed Under: Business Musings

Greetings happy SoapQueen team – I hope you’re having a great weekend. I know I am. It’s a rare weekend in Bellingham without a billion things scheduled. I’ve had the luxury of a great 90 minute ‘flow’ Power Vinyasa Yoga – Level II class (which was the opposite of relaxing), Farmer’s Market cupcakes (spiced apple with caramel buttercream frosting), lunch with a friend (at the incredible Old World Deli in Bellingham) and I made great progress on my book club book, “One Hundred Years of Solitude” by Gabriel Garcia Marquez. All in all, an excellent first day in a fantastic weekend.

Filed Under: Business Musings

I recently attended a 1 day Jack Canfield seminar. Jack Canfield is the author of countless books (including the Chicken Soup for the Soul series) but my favorite book he has written is ‘The Success Principles’. Reading and doing all the exercises from that book is like a crash course MBA. When he came to Seattle, my entire Mastermind Business Group signed up for a table and spent a full day learning from Jack. He is an excellent speaker – humble, enigmatic and thought-provoking all in one – so spending from 8 a.m. to 6 p.m. in a hotel conference room was not a hardship.

The first lesson he drilled into our heads was that we must take 100% responsibility for our lives. This means that when something goes wrong, instead of immediately blaming (“It’s Mary’s fault! If she had just finished writing up the description for Monkey Love on Friday, we could have had that fragrance up in time for the weekend!”), we should stop, take a deep breath and ask “What was my part in this? How could I have changed things?“

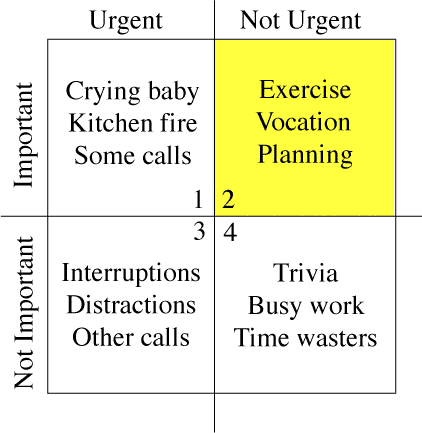

Jack taught us the following formula:

where E is Event, R is Response and O is Outcome.

Simply put, every outcome we have in our life can be controlled by our response to the initial event.

Event: You present your products to a store, only to be turned down.

Response: You say “Thanks” and walk away.

Outcome: You have no wholesale account.

Event: You present your products to a store, only to be turned down.

Response: You say “Thank you. Under what circumstances would you consider adding my line?”

Outcome: The manager tells you “Well, you don’t have any fragrances I like. If you had fragrances I liked, I’d add the line.” You rework your fragrances and add an account.

Quoting directly from Jack Canfield:

The truth is…when confronted with a negative event, successful people look for ways to transform that negative into an opportunity for achievement and greater success.

They simply respond differently.

Think about almost every negative thing in your life. What is your part in the situation? How can you change your internal dialog to constantly say “I accept responsibility for this situation. What action steps can I take now to prevent this same outcome in the future?” After all, don’t we all want to lead lives of distinction with boundless joy, unbridled optimism and endless resources? Taking responsibility and recognizing that we can change each and every situation is the first step.

Filed Under: Business Musings

Filed Under: Business Musings

Yesterday, I announced the winner of the Money Wi$e contest. It was a totally random contest so I didn’t get to play favorites with the answers. I had asked participants to leave a comment on the blog and share their best money saving tips (for our current eh hem, challenging economic situation). There were so many great money saving tips that I had to share a couple of my favorites…

Denette: Budgeting and money management has been a topic on my mind a lot lately and was so excited to see your post about it!! Here are a few tips that have really helped me:

1 – I will echo a few others here and suggest making your own meals including lunch for work. When my husband was in grad school we went 9 months without eating out! This was difficult in the beginning with our “date nights” but once a week I made a special dinner and ate by candlelight. It was really fun to try new cooking techniques and it was quite romantic to boot! Taking the time to develop my skills in cooking/baking not only helped my family during a financial crunch time, I also have these skills that I can teach to my children to help prepare them for the future and help them become more self-sufficient!

2 – Pay yourself first! When pay day rolls around, we take 10% of our net pay and split it into 2 different savings accounts. Two-thirds of that amount goes into one savings account that we don’t dip into unless it is an emergency or until we have enough saved up for our large purchase we are saving up for (right now that would be a down payment on a house!), and one-third of the amount goes into a second savings account that we use for unexpected or less often purchases like car repairs. Most people don’t need to split them up, but this helps us out because we can see the progress we are making on saving up for our home while we still have money set aside that we can use for other purchases.

3 – Save your change! It is a rare occasion that I pay in cash, so I am talking about saving your change from your debit card/checking account. Now, some banks will do this for you, but mine doesn’t so I keep track of it on my own. I have actually been doing this for about 10 years now and it is crazy how fast it all adds up! What I do is I document in my checkbook registry the purchase I made and then in the balance column I put down the amount I spent rounded up to the nearest dollar and then I write down the difference in the deposit column. I write my whole registry in pen and the change in pencil so I can keep it strait. For example: I just paid my cell phone bill which was $56.45, so in the balance column I deduct $57.00 from my balance and I added 55 cents to my running total of change! Over the past month I have saved up almost $17 just in change! Every six months we take the saved up change and make an extra payment towards our debt. If you don’t have any debt you could use that change to treat yourself to something nice like a vacation or extra holiday/birthday money! My parents have been doing this for years and have used this money to build a new deck, take a trip to Europe, and just recently bought two new wave runners!

Financial freedom has really been on my mind a lot lately and I loved reading all the fantastic advice and comments, a few of which I will be implementing into my routine so thanks everyone!

Donna Maria Coles Johnson: Use coupons and cash.

Coupons. Contrary to popular belief, there are coupons out there for healthful food items. You just have to keep an eye out for them. Sometimes, grocers have coupon stickers on items that offer discounts on the spot. For example, yesterday, I purchased two quarts of Organic Valley Farms milk. Each container had a .75¢ coupon stuck to it. The regular price of each was $2.50. Since it was triple coupon weekend at the store, I paid 50¢ for $5.00 worth of organic milk! That’s $4.50 more in my pocket, without even trying — just being on the lookout for the bargain. As you shop, keep an eye out for opportunities to use coupons. If you’re more industrious, clip them in the Sunday paper and in inserts that come in the mail. By clipping coupons, I save hundreds of dollars a year!

Cash. Another tip is to use cash for non-business purchases. Forget using credit cards — we ditched ours years ago and are debt free, except for the mortgage. (No car payments either.)

When I say use cash, I don’t mean a debit card either. I mean green dollar bills. You’ll be amazed at how many more of them you will hold onto if they actually have to slip through your fingers with each purchase. It’s easy to swipe a card, and when we do, it doesn’t feel like we are spending that much, when we really are. But when you have to actually count out the dollar bills, you’ll think twice before putting them in someone else’s hands!

I withdraw a certain amount of money from our checking account each Sunday or Monday. I use it for all of that week’s home-related purchases — food, toiletries, personal items, clothing — everything except home repairs and maintenance. I always take out less than I think I’ll need to really challenge myself. I am rarely out of cash at the end of the week, and I have not even touched the ATM. I hold onto a lot of money this way.

There are only 4 things you can do with money: spend it, save it, invest it or donate it. Because I spend with coupons and cash, I have more left to save, invest and donate!!

Thanks for the opportunity to share, and I hope these tips are helpful. dM

Filed Under: Business Musings

I listened to a great audio CD on the way to work this morning – an interview with Wayne Dyer by the publisher of Success Magazine. Aside: if you don’t subscribe to Success Magazine and you’re a small business owner, you should. It’s chock full of business advice, interviews with inspirational leaders and practical day-to-day advice on how to stay positive, focused and goal-oriented in good times and bad.

I listened to a great audio CD on the way to work this morning – an interview with Wayne Dyer by the publisher of Success Magazine. Aside: if you don’t subscribe to Success Magazine and you’re a small business owner, you should. It’s chock full of business advice, interviews with inspirational leaders and practical day-to-day advice on how to stay positive, focused and goal-oriented in good times and bad.

Filed Under: Business Musings

There’s a reason clichés are …. cliché. There are many experiences that are universal. Yes, I’ve watched a pot not boil. I too have counted my chickens before they hatched and had my back against a wall because I bet my bottom dollar barking up the wrong tree.

Filed Under: Business Musings

1. Tell us about your company?

2. What was the reason you started your own business?

3. What is your secret to success?

4. What has been your biggest challenge and how did you solve it?

5. If a women from Women Business Owners called you and ask you what was your most important lesson – what would it be?

It’s going to be a lot of talking in one fast hour! And in case you’re wondering, there is no ‘secret’ to success. It’s a combo of luck, being in the right place at the right time, a great support network and loads of hard work. I have a big announcement to share with you later tonight and I can’t to get home and tell you about it.

Filed Under: Business Musings

Filed Under: Personal Ramblings

A study published in June in the journal Neurology found that older people who exercise at least once a week are 30% more likely to maintain cognitive function than those who exercise less.